Neolink Announcement – Red Sea Crisis Update – Impact on Global Trade and Shipping to Australia – 20.12.23

Dear Valued Neolink Customers,

I hope this message finds you well and you are all looking forward to spending some time with your families over the holidays.

We are reaching out to inform you about the recent developments in the Red Sea that may affect your shipments and global trade.

As many of you are aware, the Red Sea region has experienced heightened tensions over the past week, leading to a series of Houthi attacks on shipping vessels navigating through the Suez Canal. These unfortunate events have raised concerns about the safety and efficiency of one of the world's most critical maritime trade routes. Most of the worlds major shipping lines are now rerouting cargo around Africa via the Cape of Good Hope for Safety reasons, but this has inevitably created additional transit times and additional costs for the shipping lines.

At Neolink, we understand the vital role that smooth and secure shipping plays in your business operations. Therefore, we want to provide you with an overview of the current situation and its potential impact on your shipments to and from Australia.

Overview of the Red Sea Crisis:

The ongoing conflict in the Red Sea region has resulted in increased security risks, particularly in the vicinity of the Suez Canal. The Houthi attacks on shipping vessels have prompted heightened security measures and operational challenges for vessels transiting through this strategic waterway.

Impact on Shipping to Australia and Global Trade:

-Potential Delays: Due to the heightened security measures and the need for increased inspections, there may be delays in the transit time of shipments passing through the Suez Canal. This could affect the overall supply chain and delivery timelines.

- Alternative Routes: To mitigate potential disruptions, Neolink is actively exploring alternative shipping routes to ensure the smooth flow of goods to and from Australia on goods that are yet to departing or exporting to the EU. We are working closely with our partners and logistics experts to identify the most efficient and secure alternatives.

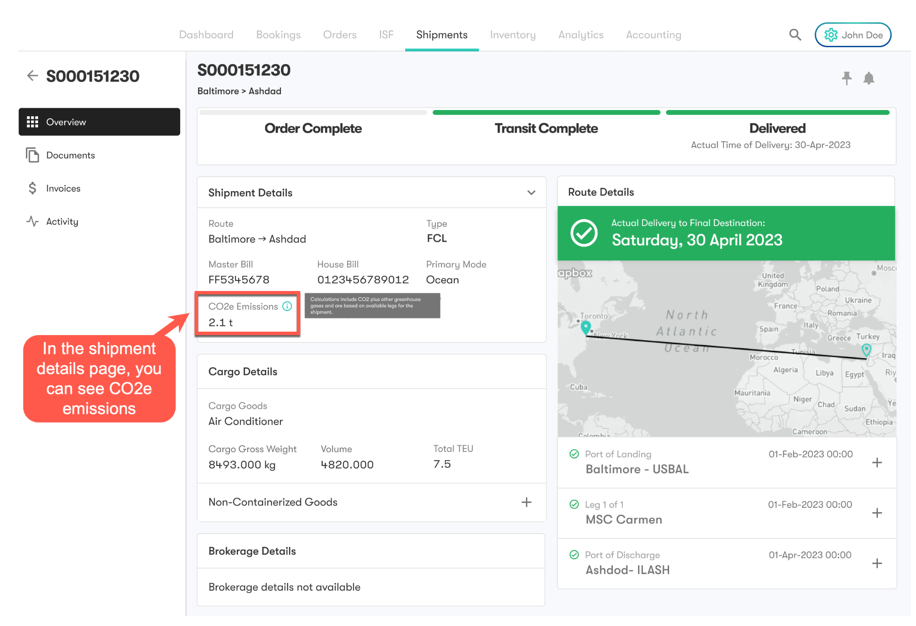

- Continuous Monitoring: Our team is closely monitoring the situation and will provide real-time updates as necessary. We remain committed to keeping you informed and minimizing any potential impact on your shipments. I highly recommend to all customers that if you do not have access, to sign up for Logixboard via our website where you can see your shipments on vessels in real time via the platform in addition to Neolink’s customer operations team being available.

What Neolink is Doing:

1.Dedicated Support: Our customer support team is available to address any concerns or queries you may have regarding your shipments. Feel free to reach out to us through the usual channels.

2.Proactive Planning: Neolink is proactively working on contingency plans to ensure that your shipments are routed efficiently, considering the evolving situation in the Red Sea region. If you have an order with us or a shipment already departed that was planned to travel via the Suez from EU, the team will be taking a tailored approach and reaching out to you all one by one. If you have any factory orders that are not in our system or our team are aware of, please reach out to us and let’s plan forward together as best as possible.

In addition to the above, many of you will also be aware of the issues plaguing Australian Ports at the moment due to the Union Strikes and Protected Industrial Action. We have seen the unloading time of vessels increase from 2 days average to 10+ days. Please take this into consideration in addition to the current crisis impacting the Red Sea. If you import from Europe, it is feasible certain shipments could experience some significant delays compared to a normal period where the Suez Canal is not closed, and we did not have Protected Industrial Action across Australia’s Port Terminals.

We understand that these circumstances may raise questions and concerns, but also ultimately create challenges to your supply chain. The team here at Neolink will be working through this time of the year (excluding public holiday) and are proactively this week still reaching out to our customers that are open to ensure we are getting factory orders in time, or planning to air freight where possible on any urgent cargo that could be impacted by these delays.

Rest assured, the entire team here at Neolink is committed to providing transparent communication and finding solutions to minimize any disruptions to your business, but these delays do need to be accounted for within your supply chain and we want to ensure you are empowered to make the best decisions for your business.

Thank you for your understanding and continued trust in Neolink. We will keep you updated on any significant developments and remain at your service for any assistance you may require.

Best regards,

Neolink Marketing Team

Neolink Launches EcoTrack: Revolutionizing Sustainable Logistics with Eco-Friendly Shipping Solutions

Real Time CO2 Monitoring & Offsetting Emissions for Sustainable Logistics

Today Neolink is proud to announce the launch of EcoTrack with our partners, an innovative product within our Logixboard Shipping Platform designed to meet the growing demand for sustainable and environmentally responsible shipping practices.

Consumer Demand & Regulatory Landscape Drive Sustainable Logistics Growth

In response to the surging consumer demand and evolving regulations emphasizing sustainable logistics, Neolink has introduced EcoTrack to empower businesses to monitor and offset their shipment emissions effectively. Recent studies undertaken by AP Moller, Oxford Economics, WWF, and Lune revealed that 86% of supply chain leaders consider a sustainable supply chain a key competitive differentiator. Additionally, 42% of consumers are willing to wait longer for products that are better for the environment. But most importantly that 70% of shippers would offset shipments if this was easily provided through a Logistics Partner.

EcoTrack Features & Benefits

EcoTrack, integrated via Neolink's Logixboard Platform, offers a comprehensive solution for businesses seeking to address their carbon footprint:

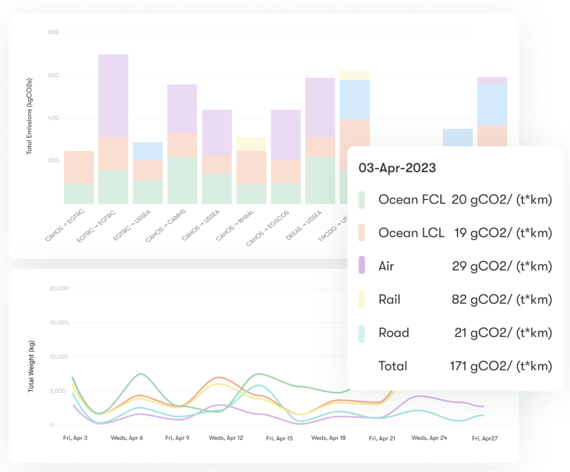

2. Detailed Analytics: Gain access to detailed analytics and emissions impact analysis across the entire supply chain, providing valuable insights into areas for improvement.

3. Compliance and Accreditation: Partnering with Lune, EcoTrack's methodology is compliant with the Global Logistics Emissions Council (GLEC) Framework, ISO 14083, and is audited and accredited by the Smart Freight Centre.

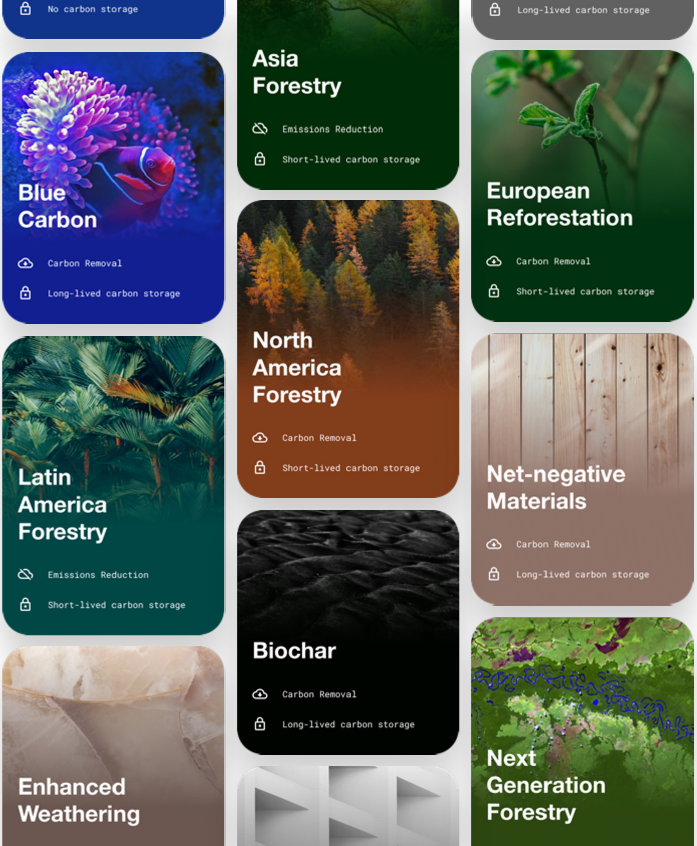

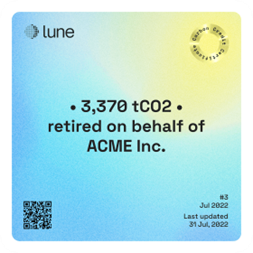

4. Carbon Offset Programs: Neolink enables businesses to understand and reduce their environmental burden by connecting them with high-quality carbon offset programs. Customers can make carbon-neutral shipments the default choice when using Neolink's services.

High-Quality Carbon Offsetting with EcoTrack

EcoTrack distinguishes itself by offering a curated list of high-quality carbon offsets and innovative carbon removal projects from around the world. The projects are meticulously vetted through in-house analysis and external evaluations to ensure their credibility and effectiveness in mitigating environmental impact.

Taking Action with High-Quality Carbon Offsetting

By choosing EcoTrack, Neolink customers can take meaningful action to offset their emissions responsibly. As an example, for just $12 USD, a container shipment from Shanghai to Rotterdam can be made carbon neutral using Forest Conservation Projects. This initiative is certified through the Verified Carbon Standard, providing transparency and credibility.

Making Sustainable Shipping the Default Choice

Neolink encourages businesses to make sustainable shipping the default choice by utilizing EcoTrack. The platform facilitates not only carbon monitoring but also proactive steps toward reducing the environmental impact of logistics operations.

For more information on EcoTrack and how Neolink can help your supply chain transform logistics into a sustainable endeavour, please feel free to contact our commercial team at sales@neolink.au or your Neolink representative.

About Neolink

Neolink are a New Age Global logistics and Supply Chain company, catering to the dynamic needs of Australian Importers and Exporters. Our comprehensive services span global air and sea freight, customs clearance, efficient warehousing, sustainable shipping, and specialized eCommerce support. Since being established in 2017, Neolink has rapidly become one of Australia's fastest-growing companies, recognized on prestigious lists such as the Smart 50 (2021, 2022), AFR Fast Starters (2021), AFR Fast 100 (2022), Deloitte Tech 50 (2022), and Business News Australia’s Australian Young Entrepreneur of the Year for Service Providers (2022). Our pride lies not just in industry accolades but also in being acknowledged by Great Places to Work® as one of Australia's Best Workplaces™️ in 2022. At Neolink, we are more than logistics; we are a team committed to innovation, customer satisfaction, and redefining industry standards.

Neolink Announcement – DP World Cyber Attack, Ports Slowly Begin to Reopen – 13.11.23

Dear Valued Clients,

Good Morning and Hope you all had good weekends.

As most of you may have seen in the mainstream news over the weekend, DP World Australia detected a Cyber Attack last Friday.

For those of you that may not be aware, DP World are one of key terminal operators across Australia’s ports controlling approximately 50% of the container volume that comes in and out of Australia. As such, DP World has since engaged a number of cyber security experts and government bodies/authorities to help them address the incident. The main action that they took on Friday way to shut down landside access to their terminals and thus cancelling pick up slots from transport providers, effectively not allowing customers to collect their cargo.

However, this morning we have been made aware by the Freight & Trade Alliance (FTA) & Container Transport Alliance Australia (CTAA) our industry bodies that some services have started to slowly resume in Brisbane and Melbourne, releasing some slots for container bookings. In addition, some of our Transport Managers have slowly started providing us with information that slots are also now being slowly released for Sydney Import collections only.

Our next steps as your Supply Chain Partner in the coming day/s and week/s ahead:

As you will all be aware from our last announcement, DP World are still going through the negotiations of a new collective bargaining agreement with the CFMEU, and we have already seen multiple vessels omit ports and offload cargo in other cities (as is their rights as per their bill of lading/terms and conditions) if the terminals cannot guarantee certain minimum turn around times for their vessels.

At this point, it is difficult to understand the degree to which this incident over the past few days is going to have on the port efficiencies as we head into Christmas or what action the shipping lines will be taking in the weeks ahead, but our belief is it won’t be a positive one and there is going to be disruption as we head into December.

You will be hearing proactively from our team in the coming day/weeks ahead and ensuring you are well equipped with all the information possible to make the best decisions for your supply chain as we head into the festive season.

If you have any questions, please feel free to reach out to your Neolink representative.

Best regards,

Neolink Marketing Team

Updated Neolink Terms & Conditions - 10.11.23

Neolink Logistics & Distribution Pty Ltd - (ABN - 65 614 643 4543) has recently updated its:

Copies of the new documents are attached to this post and are provided to all new customers prior to engaging with Neolink.

Neolink require all customers to sign our credit application & accept our terms of service before we commenced trading.

The new T&Cs will take effect from this date and will apply to all services provided after that time.

If you have any questions, please feel free to reach out to your Neolink Representative.

Best regards,

Neolink Marketing Team

Neolink Announcement – Brown Marmorated Stink Bug (BMSB) Seasonal Measures 2023 to 2024 – 30.8.23

Dear Valued Clients,

We hope this message finds you well.

As a trusted global freight forwarder serving Australian importers and exporters, we are committed to keeping you informed about critical updates affecting your shipments.

With the new season rapidly approaching, we want to ensure you are aware of the latest developments regarding the Brown Marmorated Stink Bug (BMSB) seasonal measures (all information below is also on the Department of Agriculture’s BMSB Resource Hub)

What's New for the 2023-2024 Season:

BMSB Seasonal Measures Overview:

BMSB Measures for Goods:

Treatment of Target High-Risk Goods:

Containerized Goods (FCL, FCX):

Break Bulk Goods:

LCL and FAK Containers:

Known Risk Pathways and Supply Chains:

Treatment in Australia and New Zealand:

Target Risk Countries:

The following countries are classified as target risk (as of 30.8.23):

Albania

Andorra

Armenia

Austria

Azerbaijan

Belgium

Bosnia and Herzegovina

Bulgaria

Canada

Croatia

Czechia

France

Japan (heightened vessel surveillance only).

Georgia

Germany

Greece

Hungary

Italy

Kazakhstan

Kosovo

Liechtenstein

Luxembourg

Montenegro

Moldova

Netherlands

Poland

Portugal

Republic of North Macedonia

Romania

Russia

Serbia

Slovakia

Slovenia

Spain

Switzerland

Türkiye

Ukraine

United States of America

Uzbekistan (new)

The following countries have been identified as emerging risk countries for the -BMSB risk season and may be selected for a random onshore inspection:

United Kingdom and China

China – random inspections will apply to goods shipped between 1 September to 31 December (inclusive)

United Kingdom – random inspections will apply to goods shipped between 1 December to 30 April (inclusive)

In addition to the target high risk goods, chapters 39, 94 and 95 will be subject to random inspections for emerging risk countries only.

Emerging Risk Countries:

Emerging risk countries include the United Kingdom and China, with random inspections during specific timeframes.

Target Goods Subject to Measures:

Measures for Vessels:

Approved BMSB Treatment Options:

Three treatment options are available: Heat, Methyl Bromide, and Sulfuryl Fluoride. (BMSB Resource Hub Link for full list)

Treatment Minimum Standards:

Providers must adhere to minimum standards to ensure effective treatment.

Onshore and Offshore Treatment Providers:

Treatment providers in target risk countries must be registered and 'approved. (BMSB Resource Hub Link for full list)

Neolink does not have single set approach to BMSB Season for all of our customers, this is done on a customer-by-customer basis depending on the supply chain you run and as such we may present/recommend different solutions accordingly.

Our team will be proactively reaching out to customers that import from target risk countries and even countries that are emerging risk to warn of the challenges that may be incurred from random inspections during this period. We highly recommend to all of our customers that they allow for some time within their supply chains to account for either origin/destination fumigation and random inspections being incurred if your company imports commodities from countries that fall into any of the key categories above.

Neolink and all of our team members are here to work with you during this period and ensure your supply chains adhere to the government’s requirements, as well as limit as much as possible the disruption to your business.

If you have any questions surrounding the BMSB period, please feel free to contact your Customer Operations Coordinator or your Business Development Manager.

Best regards,

Neolink Marketing Team

Neolink Announcement – Carriers Planning To Take Action on China to Australia Trade Lane Shipping – 8.5.23

Monday 8th of May 2023

Dear Valued Clients,

We hope this message finds you well.

As a Freight Forwarder and your Global Supply Chain Partner, we understand the importance of timely and reliable shipping services, and we are committed to keeping you informed about the current developments in the China to Australia trade lane

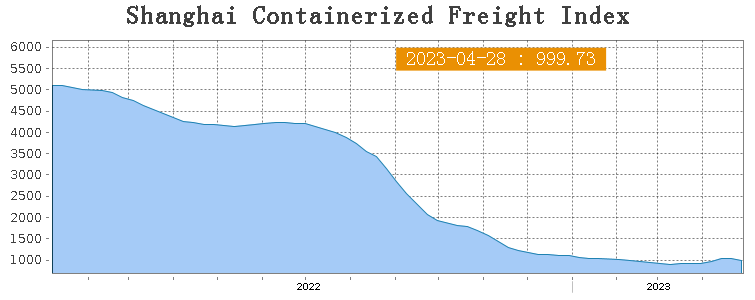

As you are aware, the first quarter of this year brought some relief from high freight rates and low schedule reliability. The Shanghai Container Freight Index (USD/TEU), which tracks all export sea freight rates from the world's busiest container port, demonstrates how far rates have fallen since the beginning of 2022 to now, with overall rates at less than 20% of what they were during the height of COVID.

See below (source: SCFI):

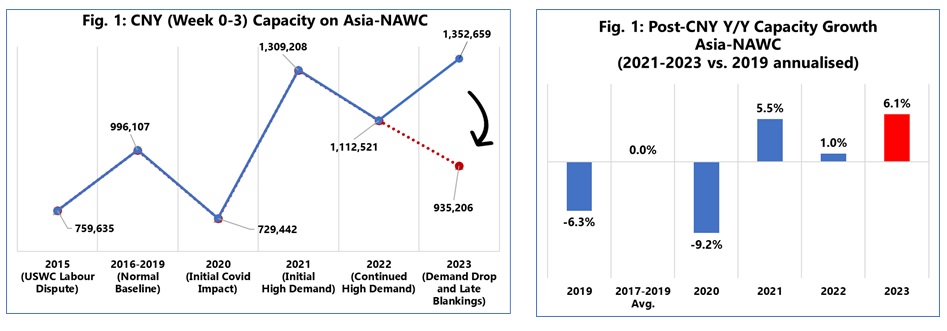

However, this has led to the lowest freight rates from China to Australia in a very long time, and now rates are well below 2019 freight rates. This is due to an increase in supply of new capacity entering the market, such as new vessels, services, and empty containers, followed by a drop in demand "post-COVID" due to inflationary pressures that most economies are now facing.

See below (source: Sea Intelligence):

Currently, it costs more money to pay the ports in Australia to remove the cargo from the vessel and make it available for collection from the wharf (Destination Port Charges on your invoices) than it costs to ship a container from China to Australia. While we understand that many in the industry may be pleased with the low freight rates, the shipping lines are doing everything they can to increase the price of the freight rates, especially on the CN to AU Trade Lane, which is well below break-even for any shipping line carrying cargo to Australia from China.

Due to all of the above factors, the shipping lines are doing everything within their control to increase their prices by utilising the supply side of the equation. As a result, they are planning to take some real action on upcoming sailings as we head into May. Our China Branch Office informed us late last week via their Procurement Department, which deals with the shipping lines in China on all of our contracts to Australia, that the carriers are planning to cancel or "blank" sailings coming to Australia earlier over the coming weeks.

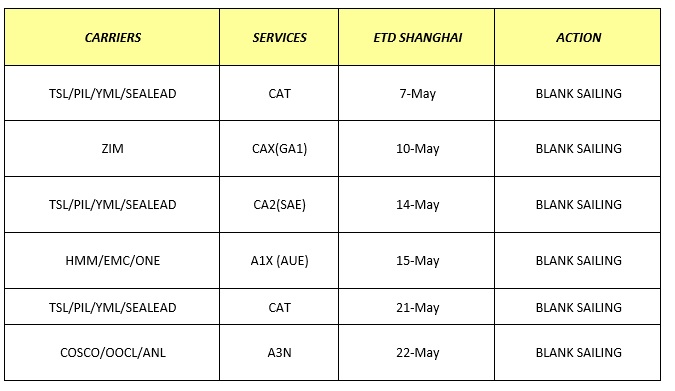

Please find below sailings that are being planned to be cancelled by all carriers. Since all vessels are calling into Shanghai, they might come from Qingdao and then go to Shenzhen. This impacts most vessels/services coming to Australia:

This is the biggest scale of action we have seen for many years with regards to blank/cancelled sailings on the CN to AU Trade Lane. This is on top of the fact that A3X and CA3 services were totally removed from the market earlier in the year.

The belief from the shipping lines is that if the market isn't pushed up after these actions, carriers will do more blank sailings like they have in CN-EU and CN-US, and CN to other trade lanes. Further to the information we have received on the blank sailings, we are also being informed by most of the shipping lines that they are planning to introduce a “Rate Restoration surcharge” USD250.00/USD500.00 PER 20GP/40HQ from China to Australia with effective date 21 May 2023.

If you have any orders with us currently waiting to be shipped in May your Customer Operations Coordinator or Business Development Manager will be in contact if it has been impacted by the above cancelled sailings.

Just like we did during the COVID period our team will work with you proactively to look at other options and seek our alternatives where feasible to keep you cargo moving – all of which will be updated in our Digital Logixboard Platform.

However, we cannot do that if we do not have your orders in our system – if you have anything in production in China that is ready in May and we are not aware, please let us know.

We can be proactive in providing different options and solutions to help best navigate the above cancelled sailings if we have advanced notice of more than a week on goods readiness.

If you have any questions at all about any of the above, please feel free to also call any member of the Operations and Business Development Team.

Best regards,

Neolink Marketing Team

Cosco RR notification from North East Asia to Australia -Effective from 21st May. 2023

OOCL Customer Advisory - Rate Restoration - North East Asia to Australia Trade - 22nd May 2023

Neolink End of Year Supply Chain Update

Friday 21st of October 2022

Dear Valued Clients,

I hope you are all well and 2022 has been better than the past couple of years.

Before we get into the update, I want to say a big thank you to you all for your continued support not just the past 12 months, but also for some over the past five years as we have grown the Neolink business – thank you again!

In this End of Year Supply Chain Update we will be covering off the below:

Global Freight Rate and Manufacturing Update

As most of you are aware, Freight rates globally have been dropping since the beginning of January and have more progressively been heading towards the $1,500 per 20 / $3,000 per 40 mark on the FBX Index for the FAK Spot market.

See below:

https://fbx.freightos.com/

Despite the drop in freight rates, we are still significantly above where the market was pre-covid and the AUD taking a hit on the USD has found it hard to slow the impact on inflation across a number of industry sectors. As all of our existing and new customers are aware, Neolink FAK rates move with the market across all trade lanes and most of you will be seeing your rates dropping on new quotations every week, as well as invoices on current shipments. Please be aware however that if you do have invoices hitting your inbox now that this is based on freight rates at the time of departure and in a lot of instances depending on the port of loading, rates could have moved significantly since that time. If you have any questions on current market pricing, please contact your Customer Operations Coordinator or relevant Business Development Manager.

Also please note that Neolink holds USD and EUR accounts and are able to generate invoices in these currencies to assist with everyone’s FX hedging strategies.

Freight rates have been dropping mainly due to a couple of key reasons globally: firstly, being the increase in more vessels and services hitting the market as container volumes soften globally – please see below:

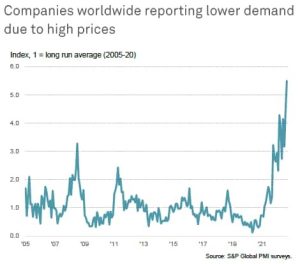

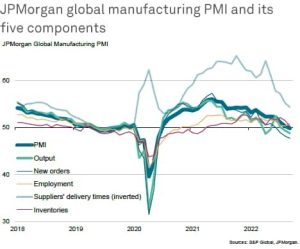

The second key driver has been the softening in container demand as global manufacturing has fell for the first time since August 2020 according to the global manufacturing PMI and which in turn is being driven by inflation globally:

The million-dollar question for everyone is at what point will demand hold and where will freight rates finish as we see central banks around the world continue to increase interest rates. What is masking a lot of the freight rate movements at the moment will be end of year planning for a lot of importers and exporters as we head into the Christmas period, which everyone is forecasting will be “softer” than previous years.

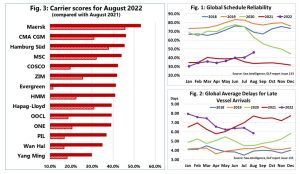

Sea Freight Sailing Reliability and Delay Updates to AU/NZ

Since the beginning of this year, we have steadily seen carrier performance and global schedule reliability slowly improve up to just under 50% as we see the market start to somewhat normalise. That being said this does still mean that over 50% of sailing schedules are not on time and in addition to that we are still seeing vessels arrive with delays of still 6 days during transit times alone – although this has also improved since the beginning of the year. This is without considering any of the delays on berthing at the terminals and in still quite a few instances we are seeing vessels taking longer to move through ports, or still rotating at the last minute which can blow out ETA’s out by up to two weeks in some instances from Asian ports.

Neolink have contracts at origin and destination with all of the major shipping lines – our priority is to always ensure our customers have a range of different options whether it be paying a premium/direct service or cheaper/longer transit options.

All in all, we are seeing all of the major shipping lines improving in their schedule reliability, albeit still significantly behind pre covid times.

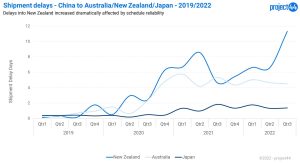

With regards to New Zealand the issue is much more challenging due to a number of key reasons. In June of this year two workers died on the ports in April due to a workplace accident and this has resulted in heightened safety regulations impacting port productivity. In addition, we are seeing that shipping lines as a result are running extremely behind schedule with delays into NZ due to the congestion and this is the worst it has been since the COVID Pandemic began – please see below P44 delay update:

End of Year & Chinese New Year Planning

Despite all of the above lingering market challenges that occur across all aspect of the supply chain; we still do have things that we can control.

One of those things is the Order Management Process and how we pre-plan/coordinate the supply chain proactively with your overseas suppliers that can help us in reducing the risk/navigating the market conditions with your shipments.

Recently we completed a full analysis across the past three years across 10,000 + shipments and this is what we learned:

All of the above gives us more time to plan with your factories and allow our origin offices more time to book space typically on quicker/direct services that are in higher demand when earlier notice is provided. For all of our customers that still do not have Christmas orders into our system, I ask that you please reach out to us and share them with our team, in addition our team are proactively reaching out to our customers everyday about your orders anyway. If anything, urgent does come in, please highlight this to the relevant team member for us to assist over the Christmas period as our team will be working excluding the public holidays.

Although it seems some time away; Chinese New Year is falling in 2023 on Sunday January 2022 and will be starting the year of the rabbit commencing traditionally 16 days of celebrations lasting until the Lantern Festival on February 5th, 2023. As office closure periods etc are announced we will certainly be updating you and making you aware, we understand some of your suppliers might be closing production earlier or later so please keep us in the loop.

Despite the market improving, we are still experiencing delays at terminals and transit times, so please keep this in mind for CNY to avoid delays ideally, we would like to have cargo ready by the end of the first week of January to ensure we do our best to risk mitigate delays/challenges with shipping.

Your respective Business Development Manager, Customer Operations Team or one of our GM’s will be speaking to you in the coming weeks regarding CNY for all of those respective clients.

New ETA/ETD Email Notifications on Neolink Logixboard

To those customers of ours that do not currently use Neolink Logixboard I strongly advise that you sign up and find out more from your Customer Operations or BDM. The platform is free of charge to all of our customers and has some amazing functionality to not only track your shipments, but see live vessel GPS data, plan your factory orders and have your accounts team find all of the relevant shipment documentation – for general info please feel free to find more info on our site: https://neolink.au/neolink-logixboard/

More and more functionality is coming to this platform – so please feel free to provide feedback as this allows us to provide feedback to the R&D Team that are constantly looking to improve its features and functionality.

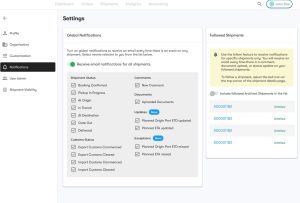

NEW this month to Neolink LogixBoard is Automated Email Notifications for planned ETA/ETD changes on your shipments.

In order to enable the notifications please follow the below instructions

Settings —> Notifications

The new notifications we add will be turned off by default.

To receive these email notifications:

Navigate to Settings, then click on Notifications

Tick the box next to the notifications you want to subscribe to.

Being transparent is extremely important for everything that we do here at Neolink and providing access to all of this information is critical to ensuring our customers can act according to the most up to date information possible. That being said, please be aware that in a lot of instances you will be finding out via automated updates based on shipping line data – some of the time we may be aware of a delay before the shipping line and update you accordingly or alternatively may occur without any notification at all from the shipping line. In the event this does occur your Customer Operations contact will endeavour to find out more information and ascertain cause, impact, and provide you with more detail as quickly as we possibly can.

Once again, thank you to everyone for your support to date and if you have any questions, please feel free to reach out to your relevant Neolink contact.

Best regards,

Neolink Marketing Team

Do you import containers to Australia? Get Ready for BMSB Stink Bug Season 2022 to 2023

Monday 15th of August 2022

Dear Valued Clients,

Its that time of year again…..

BMSB Season 2022 to 2023 will be commencing from the 1st of September 2022 to 30th of April 2023.

With regards to the timelines, this is based on goods that were shipped on vessels on/between those dates, and to vessels that berth, load, or tranship from a target risk country.

Please note: The shipped-on board date, as indicated on the Ocean Bill of lading, is the date used to determine when goods have been shipped. “Gate in” dates and times will not be accepted to determine when goods are shipped.

Essentially during BMSB Season the Department of Agriculture requires importers that import goods that are deemed high risk and from a high-risk country to be treated. There are a number of variables involved in what we can and cannot treat onshore here in Australia upon arrival, as well as what treatments/facilities we can treat offshore.

Given those variables it is really important that if you import from a target risk country to check with us if you are importing anything new or are arranging shipments on a CFR/CIF basis that we are not made aware of to provide our recommendations.

I have attached to this email the summary of what is currently as of today on the Departments website – please be aware that this can change at anytime and is important to also check the live links below:

I have also provided below a breakdown of What is new? from last year as of today:

What's New?

From 1 August 2022

Chapters 94 and 95 will be subject to random inspections for emerging risk countries

(Chapter 94 – Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; luminaires and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated name-plates and the like; prefabricated buildings)

(Chapter 95 – Toys, games and sports requisites ;parts and accessories thereof.

If you have any questions at all on BMSB Season, please feel free to contact your Customer Operations Coordinator or alternatively our Customs Manager, Halim on the below:

Halim Tjion

Customs Manager

+61478005886

halimt@neolink.au

Best regards,

Neolink Marketing Team

Neolink Joins World Wine Cargo Alliance - Press Release - 18.7.22

Monday 18th of July 2022

Neolink are today excited to announce that we have joined the World Wine Cargo Alliance effective from July 2022.

The World Wine Cargo Alliance was created by CEO Montserrat Nomen Brotons in the beginning of 2019. The idea behind this Global freight network is to gather reliable partners and agents around the world that specialize in the transport of wine and other spirits.

Neolink are proud to join the exclusive alliance, since there is a limit on the number of memberships per country. The reason for these limitations is that World Wine Cargo Alliance to be an active network in which all members can benefit from cooperation to ensure the highest standards are maintained for the Global Logistics requirements required for the Wine industry.

Neolink's General Manager of Commercial Matt Cirson has over 15+ years experience working in the Global Wine Logistics industry and has been developing our Global Wine Reefer FAK Service to Australia the past two and a half years. "Joining such an exclusive network as the World Wine Cargo Alliance is another step in the right direction as we grow our Global Logistics Offering to the Wine Industry here in Australia" he stated.

"Over the past two and a half years our Global Wine Reefer FAK service to Australia has grown significantly to now whereby we are running monthly services to Australia, which we know very few other companies can offer. This temp controlled service is important as it still allows smaller wine importers to bring in more premium wines in smaller batches and trial/test new products initially before being able to justify shipping Full Container Loads."

In the coming months the Neolink Commercial and Operations Teams that work in our Wine Industry vertical will be working closely with the WWCA members to seek additional benefits that we can pass onto our current and future customers.

If you would like more information please contact info@neolink.au

Best regards,

Neolink Marketing Team

Free Trade Agreement Announcements with Australia – India, UAE & GCC Countries – 4.4.22

Monday 4th of April 2022

Dear Valued Clients,

Hope you all had tremendous weekends.

Some of you may have seen in the news over the weekend that Australia and India have signed an intent to close on a Free Trade Agreement.

Under the deal, exports to India are expected to be boosted by at least $45B by 2035 and Australia will open a work/holiday maker program. India is forecasted to become the most populous country in the world within the next two years and under the trade deal, tariffs will be eliminated on entry for “rare earth elements” that will surely delivery a boost for mining exports in the coming years.

At this stage we are still not aware on any of the timings of when these benefits will come into place and what that will also mean for Australian importers at this point in time. Using our China-Australia Free Trade Agreement as a benchmark, the agreement was signed in 2015 and took almost up to 2 years for certain commodities to have duties/tariffs eliminated with certain documentation for customs purposes in both China and Australia. We certainly hope both Australian importers and exporters alike that this will come into effect earlier than those timelines, although it could be staggered over time depending on the goods you or your business are trading.

It is certainly welcome news in addition to the announcements in recent weeks that were made on the Australia-UAE and Australia-GCC Trade agreements – please see details attached.

If you have any questions related to the trade agreements, please feel free to reach out to our Customs department directly on customs@neolink.au for more information.

Best regards,

Neolink Marketing Team