NEOLINK Industry Update – Emerging Issues Impacting Australian Supply Chains – Q4 2020

Monday 22nd of October

Dear Valued Clients,

As the dust somewhat settles over the significant ongoing union disputes at Port Botany from September we are all left with a more costly and congested port service.

In this update we will provide some detail on both the cost and service implications for the industry, as well as the risk management strategies importers/exporters are implementing to continue to reduce the impact on their supply chains.

Below we have provided a short summary on the Key Issues Impacting Australian Supply Chains:

- Through late August and September Port Botany Terminals experienced significant industrial action that resulted in “go slows” and approved “stop work” arrangements

- Patricks CEO Michael Jovicic spoke of the impact “ We have been operating at 60% capacity. Imports are being delayed and exports are being delayed as well. We have 40-odd vessels waiting to be serviced at our terminals across the country”

- In September during the height of the action; Maersk diverted multiple vessels to offload cargo destined for Sydney to Melbourne at the cost of the importer to move the goods back up to Sydney.

- Due to the port congestion; three of the worlds biggest shipping lines have stopped sending vessels and cancelled bookings to Australia for the entirety of October – Maersk, Cosco and OOCL (see attached)

- Despite the Maritime Union of Australia agreeing to new or short term deals with the port terminal operators, NSW Ports CEO Marika Calfas stated “many of the shipping schedules remain off window and may take a couple of months to be restored back to normal. We have also seen that the Union strikes and “stop works” are still continuing, Hutchinsons have announced this morning that a 24 hour stoppage will occur on Friday the 24th of October, which will impact a number of customers that we have containers on vessels that are docked and not moving at the terminal.

- In addition to the above; the major shipping lines have implemented new port congestion surcharges for Port Botany at the cost of the importer ranging from $275 USD per TEU to $300 USD per TEU. The shipping lines are demanding this on arrival to be settled in order for the container to be allowed to be collected from the wharf. NEOLINK’s company policy on this is to pass this on at cost to all customers and will only invoice out if billed by the shipping lines

Thinking forwards the below are the key Implications of all of the above issues:

- Vessels are still taking longer to unload as per NSW Ports notice attached and are still not back at capacity despite the peace talks – Hutchinsons 24 hour stoppage tomorrow

- Supply of shipping vessels and overall services has significantly contracted meaning less container space is available from China as well as other South East Asian ports (see attached service suspensions)

- Shipping Demand from Australian businesses is not slowing down – we have seen significant growth in import volumes across a broad range of mature markets and industries (see below from NSW Ports):

- The overall increase in demand we are hearing from all our customers is putting a lot of pressure on overseas suppliers who have seen production/lead times extend

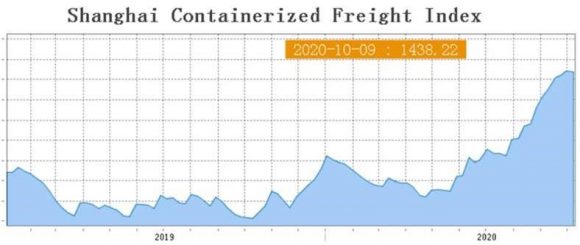

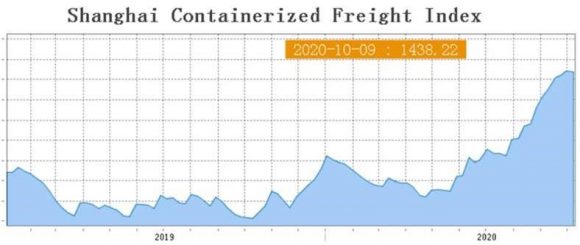

- Due to the increase in demand and the contract in supply we are seeing ocean freight rates increase in particular out of China – SCFI (Shanghai Container Freight index below):

Whilst demand remains high and shipping supply remains low or below expectations, rates could continue to increase between now and Chinese new year.

We have provided some key recommendations below and some solutions our Customer Operations Team have put in place with customers:

- Ensure your NEOLINK Customer Operations Coordinator is CC’d in on all purchase orders with overseas suppliers to forward plan

- Hold emergency stock or reserve stock where possible to mitigate for shipping delays – NEOLINK has 3PL warehousing across the country and have implemented this solution for several customers

- Airfreight is slowly coming back and maybe an option for emergency stock….. prices have significantly dropped down from “COVID” levels – we are now starting to see rates around the $3 USD per kilogram mark for +1 Tonne EX SZX

- Leverage the NEOLINK Team (third party independent view) with your customers directly to inform them what is happening in the industry. Our Senior Management are happy to set up zoom calls/meetings/telephone calls to explain what is happening in the industry to assist with managing expectations over Christmas/NY

- Speak with your NEOLINK Customer Operations Coordinator about booking tranship services to reduce costs where possible on non urgent items

As we go into the end of the year we are dealing with an environment that has changed and as such we need to continue to evolve how we operate in this climate. Our Customer Operations Team are working tirelessly with overseas suppliers, shipping lines, terminals and carriers to ensure you are getting your goods as quickly and as cost effectively to you as possible.

Our team will continue to be proactive in engaging all of our customers on their outstanding orders and do our best to ensure we keep all of your customers happy for Christmas, as well as the new year.

Bring on 2021!

Best regards,

NEOLINK Management

ATTACHMENTS/REFERENCES

1. Morrison takes aim at maritime union over Sydney port dispute – SMH

2. Despite peace talks at Port Botany, container congestion remains critical

3. Containership behemoth stops Sydney services over disruption

4. Port Congestion Surcharge – Sydney _ Maersk

5. Temporary Booking Suspension to Australia – AAA network

6. Cosco Suspension of Southbound Booking Acceptance – AAA & ASAL

7. Hutchison Port Botany Union Stop Work – 24 hours – Friday 23rd of October